Context:

The customs tariffs announced by US President Donald Trump in early April started a real trade war with several countries, especially China, with strong consequences on traditional financial and crypto financial markets.

This more optimistic perspective occurs, while the bitcoin course seeks to regain momentum, with generalized losses both in traditional markets and in cryptocurrency markets.

Trade War, Bitcoin’s great opportunity? Five key factors that lean to increase

In a detailed analysis published on the Social Network X (Ex Twitter), Ben Sigman, analyst and CEO of Bitcoin Libre, he introduced five factors to which the conflict supported by customs tariffs could trigger an increase in the value of bitcoin.

His first point focused on the potential trajectory of the US dollar. According to him, the trade war would strengthen the dollar. However, the following collapse would eventually reverse this trend.

“Prices increase the dollar. Developing markets burst in USD debt of $ 12,000 billion. Trust in trustworthy currencies is falling apart. Capital throws itself towards a fixed offer,” he said.

Sigman suggested that in this case capital could seek refuge in assets with a fixed offer, such as Bitcoins, the location of a small orange part to protect against financial instability.

He then underlined the potential of bitcoins as coverage against inflation. Import taxes often disrupt global supply chains, increase the costs of goods and slow economic growth. In response, central banks, including the federal reserve system, could reduce interest rates, thereby depreciating national currencies.

Sigman argued that the natural rarity of bitcoins and its availability in the world causes that in this case it is convincing coverage.

At the third point, Sigman emphasized the accelerated trend of de-delarization. He explained that nations like China, which are now making 56 % of their business accounts in Yuan, are increasingly looking for alternatives to the US dollar.

According to him, the BRICS coalition (Brazil, Russia, India, China and South Africa) will also develop alternative financial systems. However, this change is not without risk, as this could lead to capital leakage.

“Bitcoin thrives in a fragmented world as a neutral and global option,” he said.

For the fourth time, Sigman predicted a wave of panic in the markets. It believes that a single tariff cycle could cause a loss of market value of $ 5,000 billion, flattened bond yields and make traditional hiding as attractive, such as gold.

In such an environment, the volatility of Bitcoins could attract investors in finding high risk and high reward options until it potentially causes influx of significant capital.

In the end, Sigman claimed that the trade war could reveal systemic vulnerabilities in global institutions. Prices could therefore cause defects in repayment of debt and erode confidence in systems based on trust currencies and encourage investors to turn to bitcoins.

“Bitcoin was designed: without permission, without borders, without a bank,” he concluded.

But all analysts do not share Sigman’s optimism. Another renowned commentator in this industry, Fred Krueger, recently introduced nine forecasts on possible price taxation exceeding 100 % on China. In particular, he stressed that this measure could lead to massive drops of bitcoins and other cryptocurrencies such as Solana.

“Everything collapses at the same time. It ends at one point. Unfortunately, Trump is crazy and poorly recommended,” Krueger wrote.

Asked if the bitcoin course fell to zero, he answered the tone of the joke:

“I’ll take it completely for $ 1.”

While the tension of trade between the United States and China is intensified, supported by new taxes on Chinese products and more general geopolitical friction, the role of bitcoins in the global financial sector is carefully monitored. However, the performance of the largest long -term cryptocurrency remains to be seen.

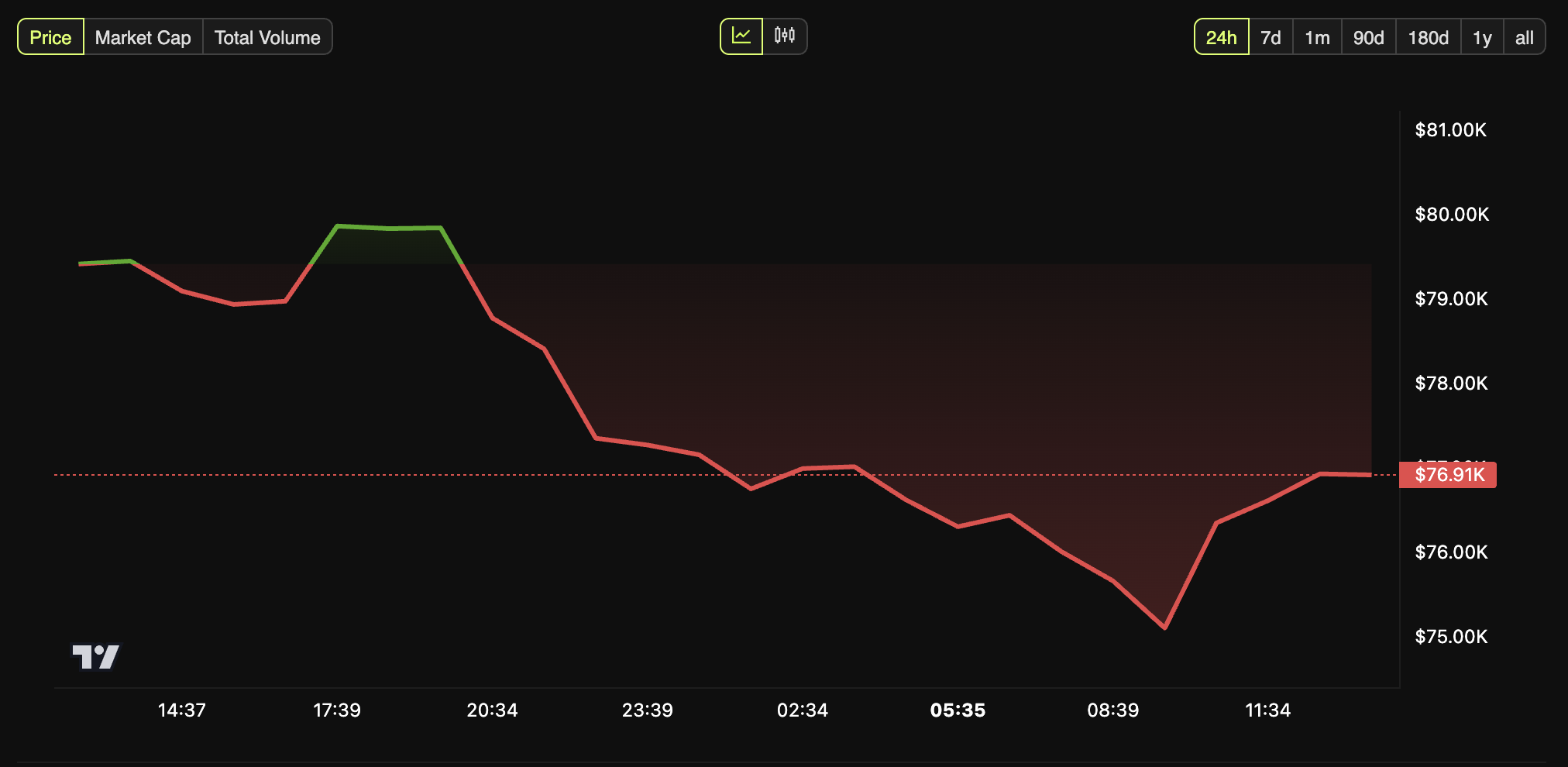

The market seems to be quite lower for now. In particular, data beincrypto showed that during the last day of BTC it fell by 3.1 %. At the time of writing this article, it was negotiated for $ 76,914.

Morality of History: When Bitcoin flourishes in chaos, it fulfills its role.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.