Figma IPO was a blockbuster – should you pursue an increase or wait for a pullback? | Motley fool

There is a reason why investors are celebrating.

31. July of the company’s design interface Figure (Fig -27.38%) I went publicly and it was an absolute blockbuster. The initial public offer (IPO) was the price of $ 33 per share. But on the first day of trading, FIGMA shares quickly flew up to $ 125 per share, which the company provided market awards of more than $ 60 billion – higher than the names for household names as Mexican grill chipotle and General Motors.

Exciment is understandable. In their submissions to be published, the figure revealed that an incredible 78% of Forbes 2000 – a running list of 2,000 largest publicly traded companies in the world – uses its design software. In addition, the returned figure last year increased by 48% by 48%.

Figma’s rapid ascent was his larger competitors unnoticed. In seven. 2022, Adobe He tried to get a $ 20 billion figma, but regulatory concerns were an agreement. Now, less than three years later, the figure has much more.

The shares hit another maximum of less than $ 143 per share on their second day of trading, but quickly reversed on the third day with a drop in 27.4%. Since the figure is still 168% of its IPO price, what should investors do now?

Why Investors are chasing an increase in the Figma Stock

According to a 2014 study published in the magazine Behavioral neuroscienceThe human brain receives dopamin intervention when it is presented with something new. This could explain the general love of IPO shares from the investment community – it seems that the new business is constant publication.

However, the IPO market has satisfied investors’ desires in recent years. After more than 1,000 IPOs in 2021, investors in 2022 and 2023 had below average IPO years. Things rose slightly in 2024, but in 2025 they really warm up.

Investors as a novelty, but the figure also captured the imagination of investors because of their impressive business.

First, the figure is growing fast. Back increased by 46% year -on -year in the first quarter. It is not only to find new customers, but existing customers also spend more money over time, as evidenced by its strong preservation of a net dollar of 132%.

The company has a stunning gross profit range of 91%. From the perspective it is even better than the gross Adobe margin 89%.

Figma co -founder and CEO of Figma Dylan Field has a history with Peter Thiel, an investor and entrepreneur who has helped to establish many businesses, included the current 20. The most valuable company in the world, Palantout technology.

Between its high growth, strong margins and valuable ties to Thiel, it was easy for investors to jump onto the band’s Figma, especially with regard to the demand for exciting IPO events.

Why may it be smart to wait

While the excitement around the stock shares is understandable, there is a good reason for investors to wait patiently on the sidelines.

To begin with, the initial increase was almost a certain thing of supply and demand. After IPO there are more than 400 million class shares and figma, but investors were offered only about 42.5 million. This means that the float for stock is low, while the demand is high, which contributes to its stunning profits (and volatility). But the float increases when the locking time expires, which allows the dedicated to place its shares on the market.

In addition, consider that the Field CEO has a 14.5 million B -Class incentive package, which is amazed at how certain stock prices are achieved (based on a 60 -day weighted diameter volume). Despite the sale of August 4, Field qualifies for three out of seven output cuts if the stock price holds at the levels of these for two months. In such a scenario, the field will receive a 45% of its incentive package, which aims to cover the 10 -year period, which will dilute the shareholder.

In addition, consider that at its current price of business, Figma has traded about 53 times watching 12 months. Even for doing business with strong growth and impressive margins, it is steep.

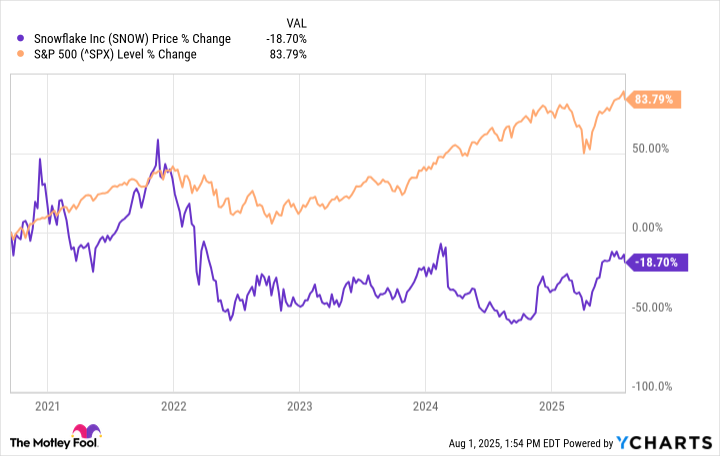

This situation reminds me Snowflake‘With IPO in 2020. It is publicly and quickly climbed to the award of more than 150 times dirty. Since then, the growth of Snowflake has been secular, but almost five years later, the stock is still 18% of the place where it was closed on the first day of trading because it was at that time.

Data charts.

Like investors, they long for a dopamine rush of an exciting IPO, it may be best to cool down for the stock. There is a good reason to believe that the current increase in the price of the shares is only temporary, even if the business is done well.

Fortunately, investors have to buy exciting IPO shares to make money on the stock market. Many well -starting businesses are in good position to generate strong revenues for shareholders for upcoming years.

Jon Quast has no position in none of the above shares. Motley fool has positions and recommends Adobe, Chipotle Mexican Grill, Palantant Technologies and Snowflake. Motley Beble recommends General Motors and recommends the following options: Short September 2025 $ 60 calls Mexican Grill Chipotle. Motley fool has a publication of politics.