1 Famous Growth Shares of 47% for Purchase on Dive, According to Wall Street | Motley fool

The Workiva platform becomes an essential tool for an increasingly complex organization.

Modern organizations often use dozens, if not suspended digital applications in their daily operations. This creates a nightmare for managers who must collect data to compile progress or comply with laws and regulations. Target Work‘with (Wk -1.73%) The flag platform relieves this burden and becomes very popular.

31. Since 2021, however, the shares have been traded by 47% below the record maximum, when the madness in the technological sector led to unsustainable heights.

Wall Street is betting that recovery will continue. The Wall Street Journal It follows 12 analysts who cover world stocks and are tremendously bulls on their prospects. Read further and learn more.

Unifying data for the most complex organizations

The Workiva platform integrates into most record systems, performance management software, cloud storage solutions and accounting applications, allowing managers to extract data from them and display it on one dashboard. Therefore, for a long time does not have to open every application of digital software. Where they use employees AlphabetGoogle disk or Working dayData can be unified using workiva.

This saves managers a significant love for time and reduces the human error, because the data is extracted to the workiva directly from the source rather than copied by hand. This platform also offers HUDREDS prepared templates to help managers quickly compile messages, whether they need to submit forms to regulatory bodies, such as the Securities and Stock Exchange Commission, to provide critical information to customers or update the managers of internal projects.

Workiva is particularly popular among organizations with strict compliance requirements such as banking, insurance organizations and even the government. In an effort to expand its potential customer base, however, the worviva in 2021 expanded to ESG (environmental, social and government) reporting space to help companies to adhere to the expanding set of regulations surround the world.

ESG solution can help organizations create framework to monitor their carbon emissions, the diversity of their workforce, and the non -final impact on the society in which they operate. ESG reports initially focused on large organizations, but new rules in regions like Europe are gradually capturing small and medium -sized businesses, creating a growing opportunity for the world.

Workiva returned growth accelerated in Q2

The Workiva generated income in the second quarter of 2025 $ 215 million, which was a leadership of $ 209 million (on Wednesday). It represents a year -on -year increase of 21%, which was an acceleration of 17% growth provided by the company in the first quarter of three months.

The strong result was caused by two things. First, the world’s revenue rate for a multi -year maximum maximum of 114%, which means that existing customers spent 14% more money than they were in the same quarter of 2024.

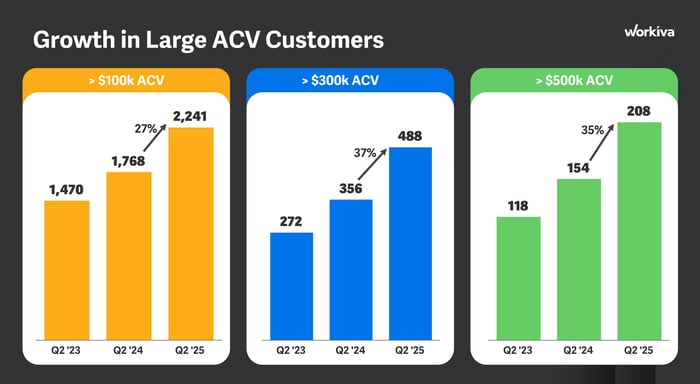

Second, Wortiva had a record 6.467 customers at the end of the second quarter, which was a 5% increase compared to this year. However, more than $ 100,000, $ 300,000, and $ 500,000 have grown faster, emphasizing the growing popularity of workiva among large, complex organizations:

Image source: Workiva.

The strong result in the second quarter caused the lead to increase its year -round income forecast to $ 2025 to $ 871.5 million (Wednesday), from the previous $ 866 million. This is the key reason why the work of the Workiva jumped 32% after the report of the company’s earnings last week got into wires.

Wall Street is tremendous bulls on the shares of workiva

The Wall Street Journal Compositions of 12 analysts who cover the work of workiva, and 10 of them gave the highest purchase rating. The other two are in the camp with overweight (bull), which means that no one recommends selling.

Analysts have an average price goal of $ 94.10, suggesting that the work of workiva can rise by a modest 11%in the next 12 to 18 months. The target on the street is $ 105, which means a little more potential up to 24%.

However, world stocks could rise even higher than Wall Street’s price goals over the long term, as the company appreciates its addressable market to an incredible $ 35 billion. He barely scratched the surface of this opportunity on the basis of his current back, not to mention that his market capital is only $ 4.7 billion right now.

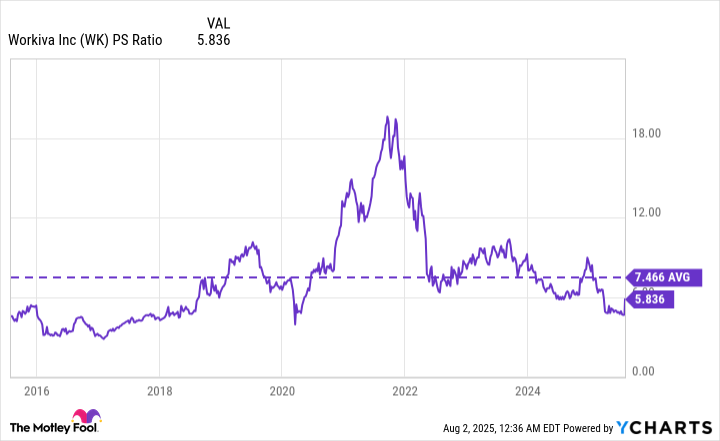

For long-term investors it could be a great entry point, because despite last week, shares are traded with the price ratio (P/S) only 6.1-A discount for their 10-year average 7.4:

WK PS ratio data using charts

When you combine the acceleration of the work of returned growth, its sizstable addressable market and its attractive appreciation, stocks look like a solid long -term purchase.