1 Unstoppable stocks that could connect to NVIDIA, Microsoft and Apple at 3 trillion dollars | Motley fool

Meta platform earnings grow over the trend in 2025 and it is mostly AI.

Eight American companies are awarded for $ 1 trillion or more, but only three have completed 3 trillion club Ultra-Excuse: Nvidia,, Microsoftand Apple. I think Meta platform (Meta 3.49%) Could join them.

Meta owns the social media platform Facebook, Instagram and WhatsApp, but also has become a clear leader in the Rase of Artificial Intelligence (AI) thanks to its Llam family with models of large languages (LLM), which is one of the strongest in the field.

The meta shares rose by 11% 31. This step raised its market capitalization to nearly $ 2 trillion, which means that investors who buy shares today could get a return of 50%if they enter the club of $ 3 trillion. That’s why I think it gets there sooner than later.

Image source: Getty Images.

AI is the META supercharging company

Almost 3.5 billion people used at least one of the meta applications in social media every day during the second quarter of 2025. Since this figure is approaching half of the global population, it will be harder to attract new users, which will have the consequences for advertising that has returned in the future. However, META can also generate more advertising dollars by increasing the time every user spends on their applications, and AI is central to this strategy.

The META Recommendation Module uses AI to learn what type of content each user has tracking, and then feeds them from it. CEO Mark Zuckerberg said this has a 6% increase in the amount of time that users spent on Instagram during the second quarter, and a 5% increase on Facebook. Simply put, Longe, which every user spends online, the more advertising sees, and more money money earns.

AI also increases the efficiency of the ad-recomendation meta by focusing more precisely, leading to a 5% increase in conversions on Instagram during the second quarter and 3% of Facebook growth. Businesses will usually pay more money for NL, where conversion grows, which is another big tail for meta.

Higher obligations and more conversions believe that META revenues are increasing by 22% year -on -year to $ 47.5 billion, which was complicated over the prognosis range of $ 42.5 to $ 45.5 billion. The management also issued a bull instructions for the third quarter (which ends on September 30), with the report to investors that the company could first return the highest $ 50 billion.

Zuckerberg says AI Superintelligence is in sight

Meta launched her LLAM LLMS family at the beginning of 2023. They are an open source, so the meta leans on the community of millions of developers to remove technical movement, which is because the best models of closed resources were caught so quickly. The latest Llama 4 models are now competing with the most advanced editions of the best starts, such as OpenI and Anthropic.

Meta uses the LLAMA models to power the new Faatures affects its social media applications, which is another way for the Boosing Committee. For example, META AI Chatbot has over 1 billion active users a month who use its skills for homework, generating images and everything in between.

Zuckerberg says AI superintelligence – which is when AI models overcome human intelligence with every metric – is now in sight. Anyone reaches this milestone who could first have a significant love for advertising over every other AI developer, which means that Zuckerberg recently founded a new division called Meta Super -surrelligence Labs. Scale AI found that Alexander Wang would lead the team after selling 49% of his company to Meta in June in agreement in agreement $ 14 billion.

However, achieving superintelligence will not be cheap. The meta allocated $ 17 billion to capital expenditure (CAPEX) during the second quarter, most of which went to build a data center infrastructure and shopping by suppliers like Nvidia. The company also increased its CAPEX forecast to 2025; He now expects to spend between $ 66 billion and $ 72 billion, an increase from $ 64 billion to $ 72 billion earlier.

Gigantic Expenditure Capex, which spent asfer in the short term, but the company hopes that it will lead to accelerated growth in the long run, because AI (and potentially super -elization) further improves conversions of users and ads.

Meta has a clear way to the club of $ 3 trillion

Fortunately, Meta’s strong rhythm on the upper line led to a very strong result on the lower line during the second quarter. Its profit (EPS) made a year -on -year by 38% to $ 7.14, which crushed Wall Street estimate $ 5.92. It brought EPS Trailing-12-Month EPS to $ 27.62, which builds its shares for the price ratio for earnings (P/E) only 28.

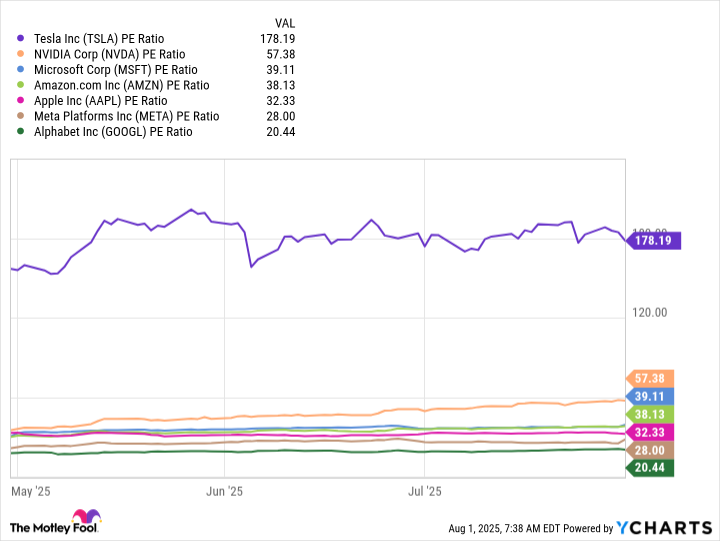

This is a remarkable discount on Nasdaq-100 The index trading with the ratio of P/E in the amount of 32.7, and it is a uniform discount to the Median ratio of P/E inventory “Magnifiment Seven”, which is 38.1. An enlargement of seven (including meta) is an elite group of technological companies operating in the front lines of AI industry.

Data ratio of PE chars

Therefore, despite the fact that in the last five years it has recorded a profit of a housing voucher, the meta can still be underestimated. It would have to increase by another 36.1%just to be traded in accordance with the median P/E magnification ratio, which would eject its market limit up to $ 1.7 trillion. At this point, Meta’s annual EPS would have to grow by only 11%to move their market ceiling over $ 3 trillion.

Over the last decade between 2014 and 2024, Meta has increased its EPS with an annual rate of 36%. This growth rate is unsustainable for a long time No But Meta’s EPS rose 37%over the first quarter of 2025, and then 38%in the second quarter, so it would not have 11%growth in the next year or two problems.

Although the META P/E ratio holds stable at the age of 28 – which I predict that it is unlikely that it seems to be so cheap – it is only a matter of time before the growth of the company’s rapid earnings is transferred to the exclusive club of $ 3 trillion.

Anthony di Pizio has no position in the actions. Motley Beble has positions and recommends alphabet, Amazon, Apple, Meta Platform, Microsoft, Netflix, Nvidia and Tesla. Motley Beble recommends the following options: long January $ 2026 395 calls on Microsoft and short January 2026 405 calls on Microsoft. Motley fool has a publication of politics.