Roblox looks like a great stock – or that? | Motley fool

Roblox has captured the imagination of millions, but great companies are always doing great stocks.

Roblox (Rblx 2.96%) It is one of those companies that have all the ingredients for growth: cultural elevator, massive user base and bold vision for the future interactive entertainment. With more than 110 million active users a day and ecosystem that resembles a mixture of YouTube, games and social media, it is no wonder that many investors see Roblox as new generation shares.

But as with many high growth stories, reality is more complicated than the subtitles. Roblox may look like great shares on the surface, but investors should take a closer look before jumping.

Roblox has that it is happening

Roblox has reached the scale level that most plafort can only dream of. Approximately 112 million people log in daily, and in the last quarter, these users spent 27 billion hours to explore games, social spaces and experiences built by independent developers. It is difficult to replicate this level of obligation.

Its platform model is particularly attractive. Intoread, how to produce your own games, Roblox provides tools for creators to build and monetize your own content, while the share of the virtual economy through the Robux currency. This dynamics creates strong network effects: The more developers build, the more players connect, which in turn attracts more creators to create even more games.

Society also pushes into new areas of growth. It is that it ages its audience to attract older demography, internationally expanding and building new streams of monetization, such as absorbing advertising and virtual trade. These initiatives could eventually turn Roblox into more than just a game company – a potential center for social interaction and digital trade in Metavers.

But there are real challenges before us

However, there are a number of risks behind the growth story that easily overlook.

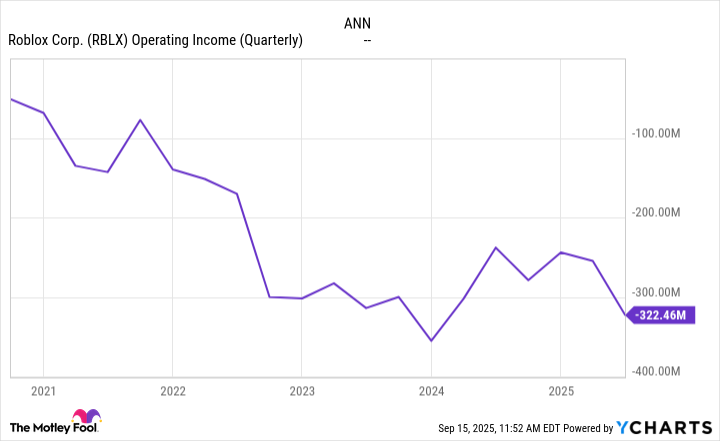

First, profitability remains out of reach. Roblox continues to create meaningful losses, driving costs for severe infrastructure, developers’ payouts and continued investments in safety, AI (AI) and international expansion tools. The business model is designed for growth rather than efficiency, making it difficult to determine when an operating lever effect appears.

Data charts.

Second, the award is steep. Roblox trades in price to sale (p/s) about 21, about seven times higher than S&P 500. In this award, investors pay for almost perfect design. Any kicking of users’ growth, monetization or cost discipline could cause sharp compression when appreciating the company.

Finly, the risk of implementation is real. While the average reservations for DAU users have recently checked, these metrics showed signs of weakness, not so long ago. International users monetize for much lower rates that those in North America, and absorbing ads are still largely unproven. In short shorts, the platform is massive, but monetization is still an unfinished work.

Looking at the roblox through the investor’s lens

Is Roblox a great supply? The answer depends on your time horizon and the risk of aputit. Bulls claim that Roblox has all the characteristics of the platform that could control the new era of interactive content with the huge potential of monetization as measured. Bears point to permanent losses of society, inconsistent economy of use and the sky as a reasons for deposit.

The truth probably lies somewhere in between. Roblox can be an innovative and culturally receiving gaming platform, but that doesn’t mean it’s a great supply. In order for the company to be great shares, it must have all the above features and be available in a reasonable valuation.

What does this mean for investors?

On the surface it seems that the story of Roblox growth almost seems to be too tempting to pass up, but its funds did not tell about the narrative. As long as Roblox proves clear progress towards profitability, its safety leaving a small space for errors.

For investors in growth, who believe in metavers and the strength of its platform, Roblox can still stand for risk-just prepared for volatility plants ahead of us because shares flirt with new historical maximums. For the rest, it may be best to stay on the siding.