The Warren Buffetta indicator is in an unmapped territory – the time they are afraid of when others arrived | Motley fool

Oracle of Omaha’s “the best only scale of where the award stands at the moment” gives all the wrong signals.

It was a banner year for Wall Street and investors. Scale S&P 500 (^GSPC 0.01%)iconic Dow Jones industrial average (^Djji 0.51%)and growth driven NASDAQ Composite (^Ixic -0.28%) All of them gathered at numerous maximum record records.

But things looked much different six months ago. Shortly after President Donald Trump revealed his customs and business policy, mini-crash followed, led by the S&P 500 to the fifth percentage decline since 1950.

Let’s say this mini-crrash spiced on April 8, Dow Jones, S&P 500 and Nasdaq Composite gathered by 24%, 35%and 50%and relevant, through the closure of the bell 2. October. This short -term fears have created an opportunity for investors to be greedy and the hallmarks of amazing discount trading companies. It’s just a type of long -term, opportunistic thinking that is made Berkshire Hathaway‘with (Brk.a 0.70%) (Brk.b 0.57%) The Millionaire (Early-By-By-Recetiring) CEO Warren Buffett has been successful in six decades.

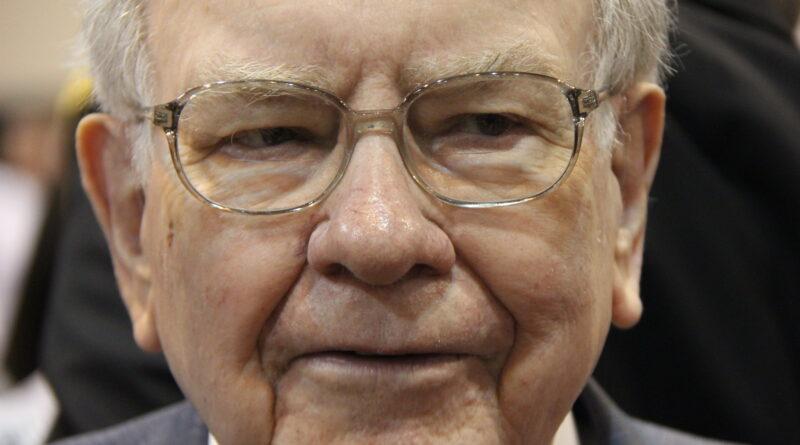

CEO of Berkshire Hathaway Warren Buffett. Image source: Motley Fool.

But most importantly, Buffett’s success stems from the introduction of ABOO everything else. While Oracle of Omaha, the concisely nicknamed, sometimes waved on some of his unwritten investment rules in terms of shares valuation, he drew a fixed line in the sand. In other words, when it makes sense, it does not buy valuation.

Last weekend, Buffett’s preferred value for stocks entered the uncharted territory.

Warren Buffett indicator has never been high

When most investors reduce the market with stock or Broade in terms of valuation, they turn to the price ratio to the yield (P/E) with the time test, which was divided by the company’s share price for its tracking 12 per share. This handy tool works great for ripe companies, but often loses its usefulness during and high growth reserves.

For Berkshire’s billionaire boss, there is no more measurement measure more CabraMassing than the ratio of the market captain to the GDP that Buffett has noticed as “probably the best only measure of the place where the award stands at the moment” Luck Magazine in 2001.

This measure increases the cumulative value of all publicly traded companies and Divids with this number by the American gross domestic product (HDP). This ratio became known as the Warren Buffett indicator.

The Warren Buffett indicator will hit 220% for the first time in the history of the stock market reached a peak at 190% during the dot com 🤯👀 bubble bubble pic.twitter.com/sge9fachter

– Barchart (@barchart) September 20, 2025

During the backward testing until 1970, the Warren Buffett indicator changed reading about 85%. This means that the total value of all publicly traded shares in the US was on average equal to 85% of the total value of US GDP when looking back for 55 years.

September 30. Buffett’s indicator closed at 219.99% and during the day inside the 220% met for a short time. This represents a high record for this valuation tool and almost incomprehensible 159% of the 55 -year -old premium.

What we witness on Wall Street, with the kind permission of the revolution of artificial intelligence (AI), is nothing but greed. Investors are chasing prospects for prospects for growth with a high sky with AI, expecting another reduction in the rate of the federal reserve system and the possible clarity of the tariff by President Donald Trump. However, premium awards of this size have never been proven sustainable.

Previous cases where the Warren Buffett indicator was basically pushed Eventually (Keyword!) They met a substantial sale. Although the ratio of market capitalization to GDP is by no means a timing tool and cannot anticipate when S&P 500, Dow Jones and Nasdaq Composite would turn over, served as a warning of dot-com bubble, a large object and in advance from 2022 bear market.

There is no doubt that it is time to be afraid when others arrived.

Image source: Getty Images.

Buffett may not be a clean buyer of shares but wisely will not bet against America

The historical Picniness of Buffett indicator, including the valuation tools, probably played a role in the persistent sales activities of Warren Buffett for the 11-quarter section (October 1, 2022-30. June 2025). Berkshire sold more shares than it is purchased during all 11 quarters, up to $ 177.4 billion.

But one thing that Oracle of Omaha did not do is to concentrate from the horizon. No matter how it may seem, how to say economic indicators or valuation measures, it may seem that billionaire boss Berkshire Hathaway fully understands that the US economy and Wall Street benefit from non -linear cycles of boom and bust.

Buffett and its best advisors are well aware that economic slowdowns and requirements have been for the US economy for several decades. No amount of maneuvering monetary policy can prevent occasionally.

At the same time, Berkshire’s boss understands that the reduction is short -term. Sence of World War II ended 80 years ago, all 12 US requirements were solved in two to 18 months. In contrast, there were two periods of economic growth, which overcame 10 years. The US economy spends significantly more time expanding than contracts, which is because it does not buy much, because the premium awards of shares will not bet against America.

The same principles apply to the stock market.

Patience and perspective are the largest allies of investors. ^SPX Data by charts. S&P 500 RETURN from 3 January 1950 to October 2, 2025.

On the basis of data published on the Social Media Platform X in June 2023 I will ban investment Group, the average sale of the S&P 500 market in September 1929 lasted “only” 286 calendar days or approximately 9.5 months. Only eight out of 27 bear markets took almost 94 years at least one year.

On the other hand, a typical S&P 500 Bull market raised 3.5 times than the average bear market (1,011 calendar days).

Warren Buffett and his successors are likely to be very awaiting the price dislocation to be submitted before planting. Although it may take a while to make sense again, to be a long -term optimist undeniably evoke Wall Street to the corner of Warren Buffet (and investors).