Context ::

Donald Trump triggered the tension of the trade with China by depositing duties to 125 %, while suspending an increase of 75 other countries. This decision caused a strong response to the markets and powered by bitcoins over $ 81,000.

Surprising reflection

Donald Trump revived Beijing climbing by announcing an increase in customs duties to 125 % for Chinese products, while suspending an increase in planned for 75 partner countries. This double wound was interpreted by markets as a sign of controlled strength, renewing strength to risky assets, but also bitcoins.

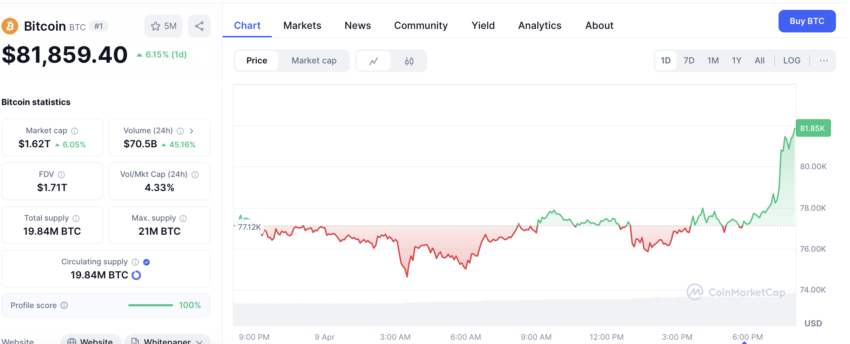

In this context, Bitcoins (BTC) flew to $ 81,800 and recorded an increase of 6 %in a few hours. Ethereum watched movement by jumping 7.75 % to $ 1,587, as well as Solana, which rose by 11.4 % to reach $ 116.

The US stock market indices also used this geopolitical balance. S&P 500 climbed to 5.7 %, NASDAQ by 6.7 %and Dow Jones by 5.4 %. On the social network Trump justified his decision by calling a desire for partial opening and maintaining pressure on China:

“More than 75 countries contacted the United States to find a solution. Meanwhile, I increase the customs prices for China to 125 %.

Technical Analysis: Bitcoin tests key support

Graphically, several analysts believe that bitcoins are currently developing in a large support area, between $ 78,000 and $ 81,000. According to Capital Rect Capital, Bull Divergence begins to form between price and RSI: while BTC continues to write cavities below, RSI shows higher and higher cavities. This type of configuration often announces the conversion of the trend, provided the support is valid.

To strengthen this scenario, a daily fence would be an ideal daily fence over a descending trend line. If confirmed, the new impulse of the ascending ascending could return BTC $ 85,000, or even more in the event of a escape confirmation.

Crypto Caesar identifies two key areas of liquidity: the green area between $ 73,000 and $ 76,000, which was already defended in November 2024, and the blue zone around $ 69,000 considered to be the final support for sale. If the BTC manages to maintain the current area, the jump could be accelerated. But in the case of a pure break, a decline on the table remains on the table to $ 69,000.

Morality History: When they strongly argue, Bitcoin uses it.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.