Is the XRP wavy in the bubble? | Motley fool

It has no world. 3 cryptocurrency according to the market value of almost 700% compared to the monitored years, too far, too fast?

During the last century, no other class of assets closed especially to rivalry with the analized revenue of shares. Although the ride from point A to B was bumpy, Wall Street proved to be the creator of Bona Fide wealth.

But it is a difficult story when the lens is narrowed to the last decade. Over the past 10 years, cryptocurrencies have absolutely crushed the analized return of the main indexes of Wall Street. Although it is primary awarded Bitcoin‘with (BTC -0.24%) The benefits of the first movement, probably not the hottest digital currency in recent years. The title belongs to that XRP (XRP 1.08%).

Image source: Getty Images.

Over the course of three years, XRP, a bridge currency developed by Ripple for its payment network, has increased by almost 700%! You want to put things into the perspective, benchmark S&P 500 (^GSPC 1.47%) He climbed 51%to the same timeline.

Although there are a number of tangible driving the Monsrous Rally XRP (which I touch Momauuryy), the unpleasant question must be asked after almost 700% increase: is XRP in the bubble?

Explanation of the Parabolic output of XRP in the last three years

Before kicking up to whether XRP has crossed its boundaries, we must first lay the foundation of how Kryptocurrencn No. 3 was the first in the world according to the market ceiling.

Arguabury The biggest catalyst for the ripple supported XRP was the victory of Donald Trump on election night. In addition to being a candidate for a Democratic Party in the White House, he was punctured to be a candidate for a Democratic Party, Trump’s victory meant the chairman of the US Securities Commission and Garer exchanging exchange. Gensler was not a friend of the cryptovisse industry and led the litigation against Ripple.

Gensler strengthens as sets of sect on January. 20 (Trump’s date was inaugurated for its second continuous term) cleaned the way for litigation against Ripple to solve minimal stir. Removing these gray clouds encouraged investors to battery to XRP.

Another catalyst is the potential approval of the Funds of TAT XRP Exchange-Traded Funds (ETF) by regulatory bodies in the future that do not work. Spot XRP ETF would allow investors a direct exhibition on them. 3 Digital currency according to market value without having to buy it on a cryptocurrency. When the point bitcoin ETF was originally approved, the inflow of cash served as a catalyst for a large digital currency in the world. The same should be expected (at least initially) for XRP if the SPOT ETF is approved.

There is also a real tool catalyst for XRP’s UPSY fueling. It is currently estimated that more than 300 global financial institutions are used for cross -border Rippletet (Ripple). Ledger XRP can verify and compare payments for only three to five seconds, with only a fraction of a penny.

The thesis is that because XRP is accepted as a bridge currency for cross -border payments, the request of financial institutions for the XRP tokens will increase its value.

Image source: Getty Images.

Is XRP in the bubble?

With a better understanding of how we got to this point, let’s go back to All-Bine’s question at hand: is the wavy XRP in the bubble?

While trying to decipher the exact peaks in supplies and cryptocurrencies, there is no more accurate than the overload of the coin, there are a number of ominous warnings that indicate that XRPs can immerse themselves in the coming months or years.

One of the more prominent worries with XRP has to do with its usefulness and acceptance. Although more than 300 financial institutions are postponed to use the Ripple payment network, it is important to realize that not all these global institutions are obliged to rely on XRP like a bridge currency. This is a potential problem for an increase in demand for XRP, which Hoop investors.

In order to build at this point, there are no guarantso that the Ripple or XRP payment platform will be the preferred option of cross -border payments. Although the XRP verifies and settles transactions in understanding and lower costs than a company for global interbank financial telecommunications (Swift), which is more than 11,000 global financial institutions relying on decades, even cross -border payments even faster.

The case for the XRP is further in the bubble when investors take a step back and realize that cryptocurrency no. 3 lacks the actual independent value. The Ripple payment network is a place where the actual value and potential of profit lies, while XRP is simply a vessel in these moving parts.

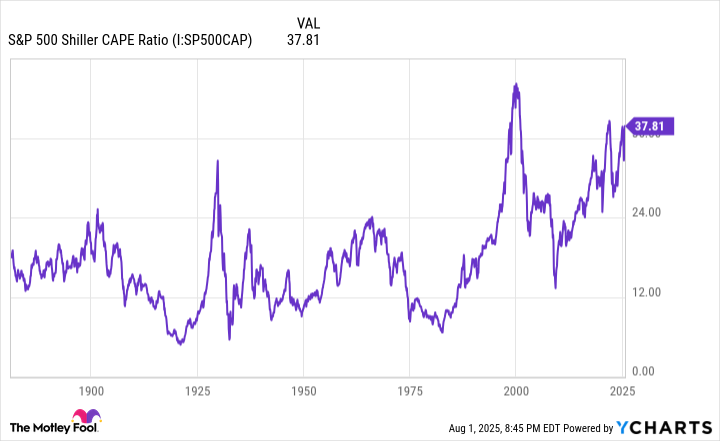

Data ratio S&P 500 Shiller Cape by Acharts.

However, history can be the most damn about all XRP warnings. Although the cryptocurrencies are separate asset classes, they seem to be attached to the S&P 500 benchmark. Although it is good news from the point of view of the S&P 500, which recently hit a new maximum, the stock market seems to be in its own bubble.

During the backward testing until 1871, the S&P 500 was using the Shiller ratio for earnings as with two opportunities with a priority. Finally, the wide index was lost 49% (bursting bubbles Dot-Com) and 25% (2022 bear market) its value based on the top KT-Trough after the other two events. Since the crypto is more volatile than the stock market, these warning signals indicate that digital assets included in XRP are in a bubble that is waiting for a rupture.

Sean Williams has no position in any of these shares. Motley Beble has positions and recommends bitcoins and XRP. Motley fool has a publication of politics.