Ondo Finance had a blockbuster July. The analyst sees Ondo exploding higher in August.

The crypto investors are immediately their attention to the other after Saw Ondo Finance announces several acquisitions, high -ranking partnerships and regulatory milestones that analysts claim that they could set an internship for explosive price action in August.

On Sunday Kyren, a popular crypto analyst on X, called “great One for $ Ondo” last month, emphasized by the launch of Ondo Catalyst with the Panttera Capital, the acquisition of Strangel and Oasis Pro, recognition in the White House report, and expanding integration for USDy, tokenized American treasury. The analyst believes that this development is just the beginning and says he feels “We are preparing for an explosion for August.”

Behind this feeling is a breath of corporate activities. At the beginning of July, Ondo Finance launched Ondo Catalyst, a strategic investment initiative of $ 250 million supported panther, aimed at scaling tokenized markets with the real world (RWA). The company also received Strangelove, Blockchain Development Studio and Oasis Pro, an American brokerage trader with SC and an alternative trading system. These trades provide technical infrastructure as well as the legal framework for expanding tokenized securities’ offers – especially on the US market.

Ondo’s Usdy Stablecoin also gains traction. In July, it was approved for integration with the Sei SEI network, a quick det-optimized layer of 1 and Alchemy Pay, Fiat-to-Ccenter. The aim of integration is to enhance the availability and adoption of USDY.

In addition to the company partnership, the Bílé House digital assets in July 2025 present the specifically mentioned Ondo Finance as a leader in accordance with tokenized financing, recognition that analysts claim to give institutional credibility. Meanwhile, the alliance of global markets has expanded to 25 members, including BNB Chain and Bitget Global, as part of wide to standardize tokenized assets of assets worldwide.

This explosion of activity has a rapid renewed interest in what Ondo Finance Actuelly is doing. The company operates at the intersection of traditional finances and blockchain and offers monitoring tokenized investment products that love the opening of financial instruments of institutional level through decentralized protocols.

Its operations cover two basic areas: asset management that proposes revenue generation products such as USDY and ous (tokenized American treasury and bond products); And a technological development that creates an intelligent contractual infrastructure of the power supply of these offers. Key loan platforms, such as Flux Finance, are part of this ecosystem, support loans and loans based on open crypt deficits and permission assets.

Token Ondo is a native useful asset for this ecosystem. It provides the rights of the holders to participate in the Gover via Ondo Dao, allows betting, reduces protocol fees and can be used as a collateral with a platform. Motivational liquidity also supports mechanisms when Ondo expands across the new chains.

In February 2025, the company launched the chain Ondo, blockchain layer 1 designed specifically for tokenized RWAS. The chain combines openness of public blockchain with compliance features, including download mechanisms that require institutional participants to ensure their activities with tokenized assets in the real world. It also native sending messages between the cross chain and integrates with traditional financial infrastructure to minimize latency and costs.

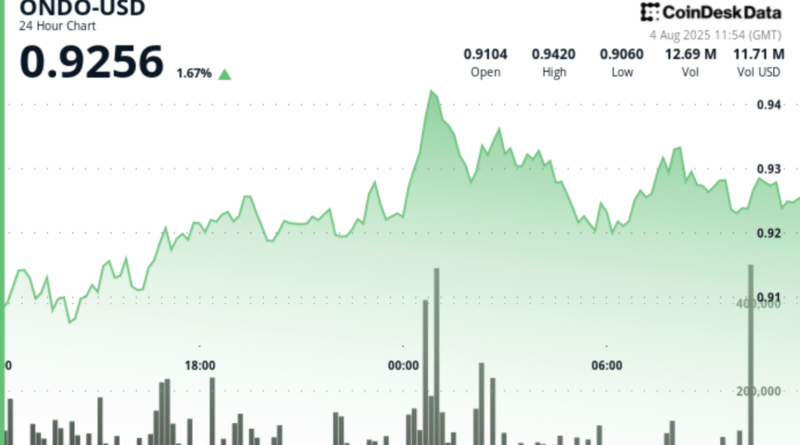

Since Monday morning, Ondo has been traded for $ 0.9256, which, according to Coindesk, is 1.67% in the last 24 hours.

Emphasizing technical analysis

- According to Coindesk’s technical analysis data model, Ondo between August 3 and 4 August and 4th August and 4th August and 4th August and 4th August and 4th August at 08:00 increased from $ 0.90.

- The most significant price movement appeared in August 4 at 00:00 UTC, when Ondo broke $ 0.92 to $ 0.94, which was supported by a volume of 7.90 million – more than twice the daily average.

- Resistance set nearly $ 0.945, which coincides with a high volume refusal after escape.

- The 24 -hour volume of overvoltage conflines the bull momentum and institutional participation at the increased price level.

- Ondo added another 1% in the last 60 minutes from 07:16 to 08:15 UTC 4 August, climbing from $ 0.927 to $ 0.932.

- The price reached a peak at $ 0.932 during a strong pressure between 07:35 and 07:50 UTC, supported by several volumes over 150,000 units.

Renunciation of responsibility: Parts of this article were created with the help of AI tools and reviewed our editorial team to secure ACCCAair and observance Our standard. See more information Complete AI Coindeska policy.